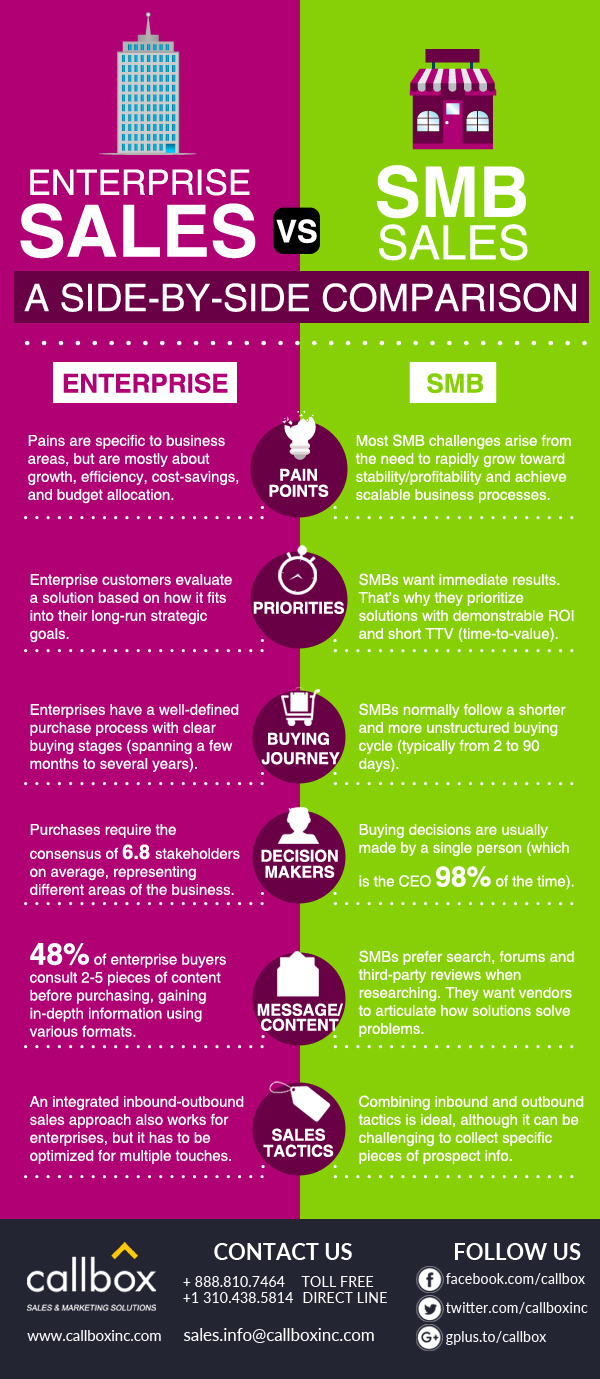

In Sales 101, we learned that selling to SMBs vastly differs from enterprise sales. SMBs aren’t just scaled-down versions of their enterprise counterparts, in the same way, that large companies aren’t simply full-blown versions of small businesses. These are two very different creatures, each with its own unique characteristics, separate needs, and (consequently) distinct sales philosophies.

In today’s infographic (and in the rest of this blog post), we’ll compare selling to SMBs vs. selling to enterprise customers and find out how the two approaches contrast with each other in terms of pain points, business objectives, buying process, decision-makers, messaging, and ideal tactics.

To make sure we’re on the same page, let’s first pin down what SMB and enterprise customers exactly are. Gartner defines SMBs in terms of employee size and annual sales as follows:

- Employee size

Small business: fewer than 100 employees; Mid-sized companies: 100-999 employees - Annual revenue

Small business: less than $50 million; Mid-sized: between $50 million and $1 billion

So, for the purposes of this blog entry and infographic, we’ll consider any business that falls outside the above ranges as an enterprise.

With that out of the way, here’s a rundown of key differences when selling to SMB and enterprise customers:

Pain Points

SMB and enterprise customers face vastly different business challenges. For example, a survey of 1,000 U.S. and European SMBs reveals that two of the biggest pain points they experience are growing toward stability/profitability (47%) and increasing productivity through workflow improvement (47%).

Meanwhile, for large enterprises, common pain points tend to revolve around specific business areas such as prolonged sales cycles, unintegrated distribution channels, poor return on IT investments, shrinking margins, inadequate reporting, and accountability, etc.

Priorities

Business priorities hugely vary between SMBs and enterprise companies. SMBs tend to focus on near-term results since they’re usually looking at shorter time horizons. That’s why, in addition to ROI, SMBs also consider a project’s or solution’s time-to-value (TTV), which is the time elapsed between decision to deployment.

Enterprise customers, on the other hand, typically have the time and resources needed to carry out longer-term initiatives that impact their strategic position (market share, recurrent revenue, etc.). They evaluate how your solution’s benefits support this overall direction.

Here is a 5-step approach that is guaranteed to give you enterprise leads and customers.

Buying Journey

SMBs arrive at a buying decision much quicker and more directly than their enterprise counterparts. While it can vary widely from one industry to another, SMBs typically complete a purchase within 2 to 90 days from initial contact.

By comparison, enterprise companies follow a longer and less linear path to purchase, with well-defined steps and identifiable buying stages, which can span anywhere between a couple of months to several years.

Related: Stages of a B2B Sales Pipeline (and Ways to Increase Your Sales Success Rate)

Decision Makers

In small businesses, purchase decisions are often made by only one person. In fact, CEOs make 98% of all tech buying decisions in SMBs, although some key steps in the buying process are delegated to others in the company.

In contrast, it takes an average of 6.8 stakeholders to arrive at a buying consensus in enterprise companies. Each stakeholder represents a specific business area or department with his/her own interest and expertise in the solution being evaluated.

Related: Savvy Ways to Identify and Qualify B2B Decision Makers

Messaging/Content

When evaluating a purchase, SMBs do their research in a way that’s similar to consumers. For example, at least half of SMB buyers choose top brands and the vast majority of SMB decision-makers rely on Internet searches and review/recommendation websites. SMBs also want vendors to clearly explain how their solutions translate into business value.

Enterprise customers use multiple pieces of in-depth content during the purchase process. Around half of enterprise decision-makers involved in the buying cycle consult between 2 to 5 content materials, including whitepapers, case studies, webinars, blog articles, etc., to evaluate a solution.

Related: What Personalization Means to Your B2B Customers and How to Implement It

Sales Tactics

Tactics, which are effective at reaching out and engaging SMB customers, include a combination of inbound and outbound channels. Paid and organic search closely match how SMB decision-makers seek information and thus are effective channels, especially when combined with the scale of email marketing and the personalization offered by targeted one-on-one calls.

Similar inbound and outbound channels apply when selling to enterprise customers. But the tactics need to lean toward nurturing enterprise sales opportunities through multiple touches with a rich content portfolio.

Related: Account-based Marketing: Why It Delivers the Highest ROI

There’s more to the SMB vs. enterprise comparison than just sheer size alone. That’s why selling to either segment isn’t as simple as scaling down or scaling up your sales strategy. Both require a hugely different approach.